As an HR professional, I recognize the crucial decisions organizations must make when evaluating the costs of hiring employees versus contractors. While it may seem like a straightforward choice based on each circumstance, there are numerous factors to consider. What is the real cost of a new in-house employee? Is one option more affordable than the other? Let’s explore the complexities of employee and contractor costs and their financial implications for organizations.

Direct Expenses

When organizations hire employees, they incur various direct expenses. These can include recruitment costs, onboarding expenses, training, and benefits like healthcare, retirement plans, and paid time off. These initial investments contribute to the overall cost of employing individuals. On the other hand, contractors typically handle their own equipment and software, training, and benefits costs, relieving the immediate financial burden on the employer.

Compensation Structures

Comparing compensation is a vital aspect of understanding costs. Employees usually receive a fixed salary or an hourly wage, along with benefits such as health insurance coverage, retirement plans, paid time off, and other fringe benefits. Employers bear the responsibility of withholding and paying employment taxes for their employees, including Social Security, Medicare, and unemployment insurance.

In contrast, contractors typically charge an hourly or project-based rate. Although these contractor rates may appear higher, it accounts for their self-employment status and includes their own taxes, tax compliance, benefits, and business expenses. Additionally, organizations that partner with a staffing vendor also have the recruitment time spent finding experienced experts that align culturally and payroll costs covered in this rate.

Flexibility and Commitment

Flexibility plays a crucial role in cost assessment. Hiring contractors provides businesses with the advantage of flexibility. Organizations can engage contractors for specific projects or time periods, scaling their workforce according to fluctuating demands. This agility can be beneficial in managing costs. On the other hand, hiring employees implies a more substantial long-term commitment. While this stability may align with certain operational requirements, it can limit the ability to quickly adapt to changing circumstances and may result in higher costs during periods of reduced workload.

Skillset and Expertise

The required skillset and expertise for a role can significantly impact cost considerations. Contractors possess specialized skills and industry knowledge, which often command higher rates due to their niche expertise. Hiring a contractor can be advantageous for short-term projects or tasks that demand specific capabilities. This approach is often desirable to eliminate direct employee expenses for shorter-term projects or task needs while gaining scalable expertise.

Conversely, employees that may require training and development to acquire the desired skillset would be the best approach if the projects are not short-term. Although this initial investment incurs additional costs, it contributes to building a versatile and adaptable workforce.

Legal and Compliance Factors

Compliance with legal and regulatory obligations is paramount for businesses. When hiring employees, organizations must adhere to labor laws, minimum wage requirements, overtime provisions, and other employment standards. Meeting these compliance requirements incurs additional costs, including legal assistance and potential penalties for non-compliance.

In contrast, contractors, as independent entities, typically assume responsibility for their legal and tax compliance. Organizations that hire contracts must be diligent to ensure that they are compliant with all state and federal contractor regulations. Additionally, organizations must engage with contractors in alignment with government guidelines surrounding financial, behavioral, and relational control. A helpful resource to learn more can be found on the Internal Revenue Service site. Partnering with a staffing vendor provides organizations with contractor legislative expertise, compliance adherence, as well as the vendor being listed as the employer of record without additional costs.

Conclusion

Evaluating costs of hiring employees versus contractors can be a complex decision for organizations. To make an informed decision, organizations should carefully assess their specific needs, project durations, required skillsets, and budgetary constraints.

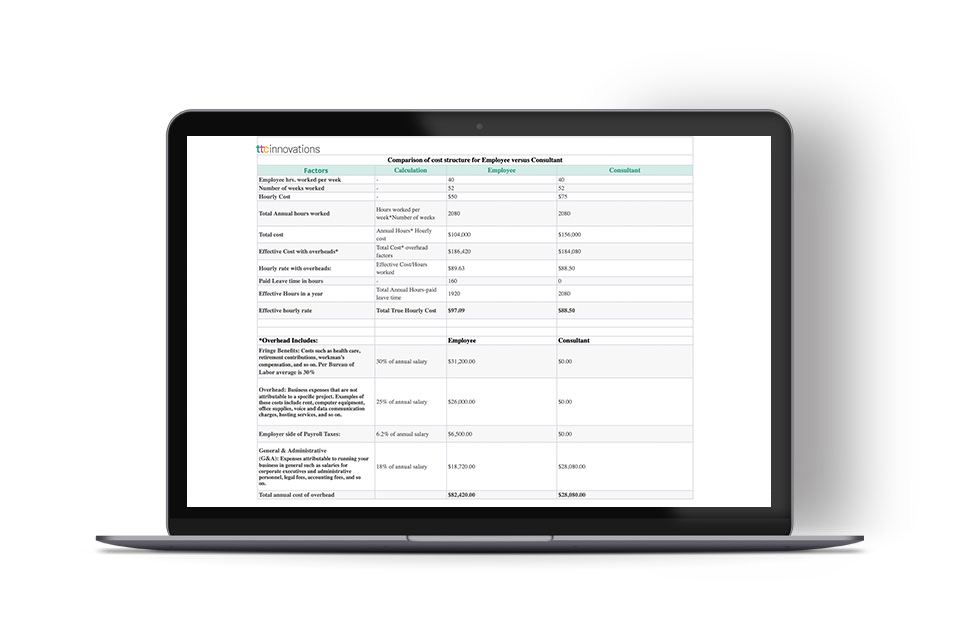

If you need assistance in calculating the costs of hiring employees or contractors for your organization, we offer a helpful cost calculator tool to guide your decision-making process.

Download our FREE “FTE vs Consultant Cost Calculator” to create a comparison of cost structure for an employee versus a consultant.

FREE Download!

Remember, choosing between employees and contractors is not a one-size-fits-all decision. It requires thoughtful consideration and analysis to determine the most cost-effective and beneficial approach for your organization.

Need more assistance in choosing a staffing partner that will suit your needs? Check out our recent blog post, How to Evaluate and Influence Training & Staff Vendor Selection (Plus, a Helpful Email Script to Stakeholders), for more insight.